Share

Share

Using Patent Intelligence for Technology Investment

Investing in a new technology area requires in-depth research before deciding if it’s the right choice and timing. Technology investments could be in the form of funds from angel investors, venture capitalists, companies or grants from the government and other institutions. Before investing in a new technology/product, you must first consider the economic, technological, and business viability followed by a risk assessment, patent valuation and due diligence. Moreover, patent data also helps you assess technology trends and disruptive innovations in advance. So, combining patent information with market data helps in making a more informed decision about research investment.

Technology Validation

Before investing in a new technology space, you need to ensure that you are investing in the right area. Studying patenting trends, evaluating the quantum of existing patents and studying technological strengths of competitors will give you an idea of the current landscape.

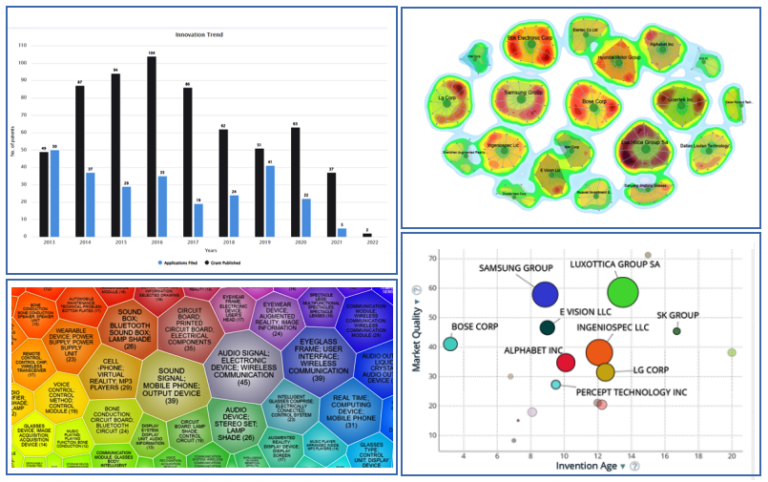

Patent Trend Analysis – Statistical analysis of the publication rate of patents in a certain field or company provides information about technology maturity and existing R&D investments in it. This helps understand if the technology is ripe for additional investments. You can further use this to stay updated on the overall technology trends in the space.

Market Interest – Patents helps you identify the key competitors that exist in the technology you are looking at. Validating the interest levels of the competition such as their level of aggression in new patent filings gives a clear indication of the market potential of the technology.

Risk Assessment and Competitor Analysis

Another step in validation is to study competitors’ existing IP and if they pose a risk to the proposed transaction. A risk assessment will provide early warning signals (if any). The following techniques listed below are used for this validation

- Identification of Competitors – Find out the number and quality of competing IP owned by other companies by doing a proper patent search of that particular technology space. Analyse their recently granted/published patents to understand if the protected technologies pose a barrier or any other type of competitive threat to the technology you are interested in. Study global interests of competitors by searching for patents filed in multiple jurisdictions based on the patent families.

- Forward Citation Study – Forward citations help forecast the evolution and impact of emerging technologies. A drawback here is that this data may not be available if the technology is very new.

- Legal Risk Assessment – This involves checking if the patent strategy has been well thought out, undertaking a Freedom-to-Operate analysis for the eventual go-to-market product, and identifying NPEs (if any) that can pose a threat to business.

Hence, patents provide business intelligence information from which the competitors’ strategies can be predicted. This can be helpful in developing your own technology strategies to counter them.

Valuation of technology assets

The valuation of IP assets is an important parameter for deciding the technology investment quantum and value. An IP valuation exercise for the existing set of IP helps decide the price point for the proposed investment.

IP valuation comprises cost-based valuation (cost estimates for innovative idea generation, patent filing and maintenance fees), market-based valuation (patent portfolio comparison with competitors on the basis of technology, portfolio size and quality) and income-based valuation (calculations of patent portfolio income during a certain time frame).

Once the technology validation, risk analysis and valuation tasks are completed, you should undertake legal and financial due diligence to mitigate any other investment risks.

Summary

Briefly put, multiple factors such as technology popularity, consumer perception, and future market trends ultimately affect your investments. Nevertheless, with thorough IP research and analysis, you can make difficult decisions about technology investments in any R&D-driven business less risky.