Share

Share

Digital biomarker technology is used to capture physiological and behavioral data, diagnose diseases and predict outcomes. It is available in the form of portables, wearables, implantables and digestibles. Popular examples of digital biomarkers include FitBits, Oura rings and Apple Watches. The digital biomarker market is expected to witness tremendous growth and according to the latest research reports, it is estimated to reach around USD 24.5-25 billion by 2030, growing at a rate of 36-37% during the forecast period.

To get a clearer picture of this rapidly growing technology, we conducted a study to evaluate the country-wise distribution of patents filed by different companies over the last 10 years. We created a search query in PatSeer using keywords related to digital biomarkers and combined it with relevant IPC and CPC classes. The final search query resulted in a set of 3000+ patent families which was then studied further to understand the patent filing trends and top players in each country.

Patent filings of top companies across various jurisdictions

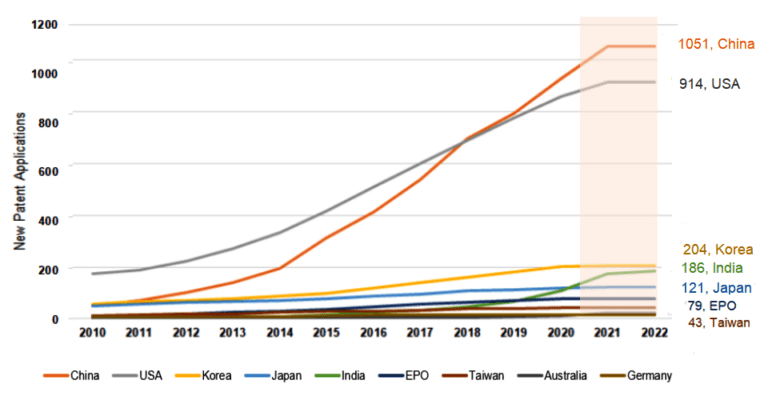

We used PatSeer’s Geo protection Growth Chart to view the growth in filings for each country from 2010 to the present.

Figure 1: Digital biomarker growth in patent applications per country (2010-2022)

Note: Patents filed in 2021 and 2022 may not have been published yet, so figures for these years should not be considered indicative of a trend.

As you can see from the figure above, the digital biomarker market has increased exponentially in the last 10 years. China’s patent filing rate is almost 7 times higher than it was in 2013, with 141 patents in 2013 and 1051 patents in 2022.

Similarly, US patent filing rates also surged upwards by approximately 250%, with 270 patents in 2013 and 914 in 2022. Other countries like Korea, India, Japan and Taiwan didn’t have a lot of patent filings earlier but are now witnessing aggressive patenting activity.

Analysis of key players

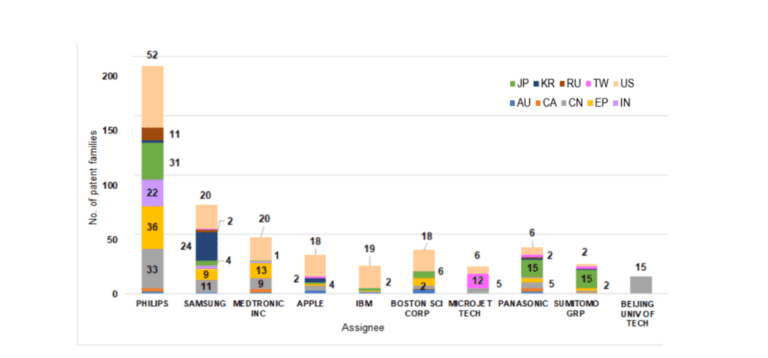

From the retrieved patent dataset, we identified the prominent assignees filing patents for digital biomarker technology. We found that some of them are leading multidisciplinary companies who are becoming key market players in this field.

Figure 2: Top Assignees

To gain a better understanding of these top assignees’ global patenting activity, we plotted a graph that depicts the number of patent families across their chosen priority countries.

Figure 3: No. of patent families filed by top assignees across priority countries

We found that Philips is the top assignee and they are protecting their inventions in many leading countries such as the US, China, Japan, EP, and India. Interestingly, Medtronic, Panasonic, and Samsung have also filed multiple patents in China apart from their countries of origin.

Conclusion

In short, our study found that leading companies had filed the most digital biomarker patents in the US and China. However, Japan, Korea, and India are catching up quickly with their high patenting activity.