Share:

In today’s age of remote work, a similar paradigm is transforming healthcare with the use of surgical robotics. Surgical robots are machines with remote-controlled robot arms that have surgical tools attached to them. These sophisticated machines, capable of performing complex procedures with astonishing precision, are steadily redefining the minimally invasive surgery space while making telesurgery/remote surgery possible.

So, who is leading the charge in this field?

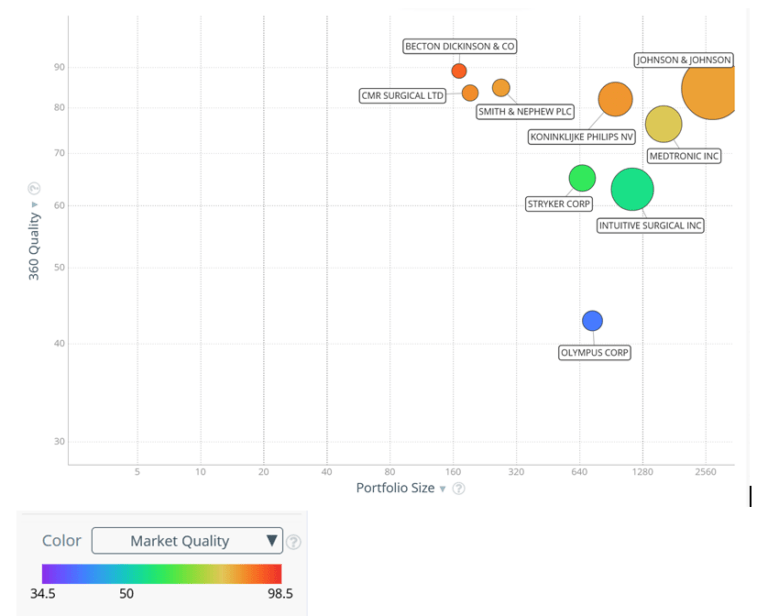

To answer this, let us take a deeper look at the patenting landscape that is prevalent in this industry. We conducted a patent search on Surgical Robots using relevant keywords and CPC classes in PatSeer. The result set was grouped by companies and plotted against its overall quality and family size.

The results were plotted in a Quality vs. Quantity chart below, which utilizes PatSeer’s 360° Quality score (combines citation, legal, market quality, and document scores) and patent portfolio size. This helps place key companies into four quadrants: challengers (top-left), leaders (top-right), marginal players (bottom-left), and underachievers (bottom-right).

Here are the key takeaways from the above chart:

- Johnson & Johnson is the leading applicant in surgical robotics based on the size and quality of its patent portfolio. Additionally, it has a commendable market quality that suggests extensive global market coverage (active patent families).

- Philips and Medtronic Inc. have comparable portfolio value indices. However, Philips’ market quality is marginally superior, suggesting its surgical robotics products have broader global coverage.

- Intuitive Surgical and Stryker Corp, present in the upper right quadrant, are also established players in surgical robotics. Their patent portfolios exhibit strong 360-quality, reflecting a robust statistical quality of the patents.

- Smith & Nephew, may have a smaller patent portfolio, but its 360-quality scores are high and therefore is backed by sound innovations that have a larger exploitation potential.

- Becton Dickinson Co, appears to have superior global market coverage, indicating a higher market quality compared to other companies, even though it holds fewer patent documents.

- Olympus Corp has been consistently improving its overall patent position in this space. While other companies might have overtaken it in surgical robot related patent filings, Olympus maintains a substantial portfolio size and with an overall portfolio quality of 45%, it positions itself as a potential contender in the field.

In conclusion, leading assignees such as Johnson & Johnson, Intuitive Surgical, Medtronic and Stryker Corp are prominent figures in the surgical robotics sector. Though not included in our analysis presented here, we came across multiple companies with smaller but exceptionally high-quality patent portfolios (reflected by a strong 360-quality score). These can represent promising investment or acquisition opportunities for the larger players.