Share

Share

Decoding IBM's acquisition of Turbonomic from a patent perspective in 60 minutes

In the blog ‘Patent Scoring in PatSeer’, we learnt about the various qualitative scores present and how they can help in deciding the value of your intangible assets. In this blog, we will discuss PatSeer’s quality scores with the help of an example to know how to implement the scores and gain important inputs for making business decisions. Let’s find out whether IBM’s acquisition of Turbonomic made clear sense from an IP standpoint

Turbonomic, an IT Virtualisation and Cloud optimisation company, was acquired by IBM in June 2021. (https://blog.turbonomic.com/ibm-acquires-turbonomic-to-power-the-future-of-ai-driven-hybrid-cloud). Turbonomic’s product simulates supply and demand forces to efficiently allocate resources such as computing, database, memory and storage over cloud computing platforms. The firm has filed patents that focus on managing application performance in virtualization systems, resources in cloud environments, and software containers.

How strong was Turbonomic’s technology and patent portfolio that got IBM’s attention? Let’s analyse this using PatSeer’s portfolio ranking and quality metrics.

Creating a patent dataset for this space (Time taken – 30 minutes)

In order to understand the landscape of patents in the virtualisation and cloud resource optimisation technology area in a quick (yet efficient!) way, we decided to simply search by CPC classes. We looked up all the CPC classes where Turbonomic patents were filed and combined them at the appropriate class hierarchy levels.

A few analyses later, we decided to use the following query: CPC:(G06F9/455$ or G06F9/5077 or G06Q10/06315 or G06F9/5011)

Note $ in the above query implies a search for all hierarchical subclasses that fall under that class.

G06F9/00 | Arrangements for program control, e. g. control units |

G06F9/46 | Multiprogramming arrangements |

G06F9/50 | Allocation of resources, e. g. of the central processing unit [CPU] |

G06F9/455$ | Emulation; Interpretation; Software simulation, e. g. virtualisation or emulation of application or operating system execution engines |

G06F9/5011 | the resources being hardware resources other than CPUs, Servers and Terminals |

G06F9/5061 | Partitioning or combining of resources |

G06F9/5077 | Logical partitioning of resources; Management or configuration of virtualized resources specific details on emulation or internal functioning of virtual machines G06F9/455 |

G06Q10/00 | Administration; Management |

G06Q10/06 | Resources, workflows, human or project management, e. g. organising, planning, scheduling or allocating time, human or machine resources; Enterprise planning; Organizational models financial asset management G06Q40/06 |

G06Q10/063 | Operations research or analysis |

G06F9/5005 | to service a request |

G06Q10/0631 | Resource planning, allocation or scheduling for a business operation |

G06Q10/06315 | Needs-based resource requirements planning or analysis |

With US being an important hub for most software patents, we restricted the search to all families with a US filing in the last 10 years. This gave us approx. 18.5K simple families (SFAM).

Analysing Acquisition Opportunities by Portfolio Size (Time taken – 5 minutes)

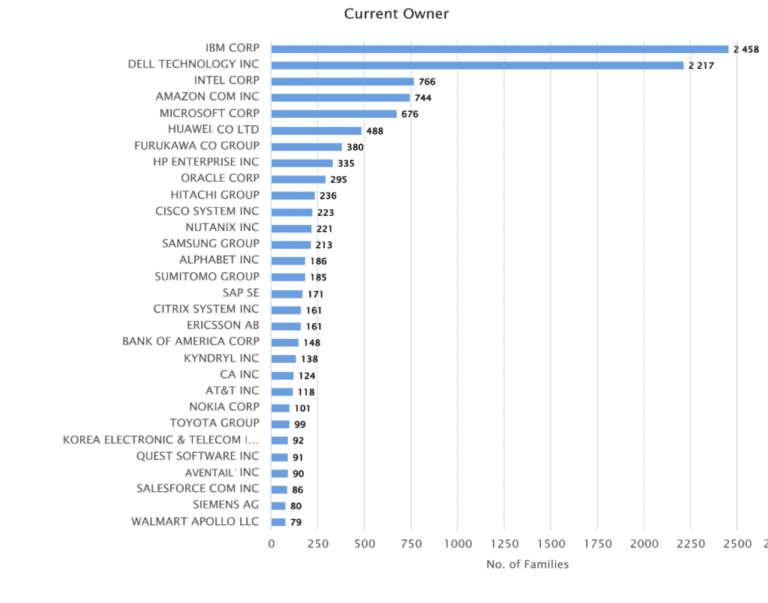

We gave a quick look to the portfolios held by the top patent holders (seen below):

Interestingly, the top 2 players, IBM and Dell have more than 3 times the number of patents held by the next 3 that follow them. Dell, with its acquisition of VMware (although it has recently been spun off since this analysis was done!) has created a dominant position in this space.

As expected, the top players are software companies and telecom companies along with some diversified companies. Most are giants in their fields and that doesn’t leave much scope for acquisitions within this list.

Analysing Acquisition Opportunities by Portfolio Quality (Time taken – 10 minutes)

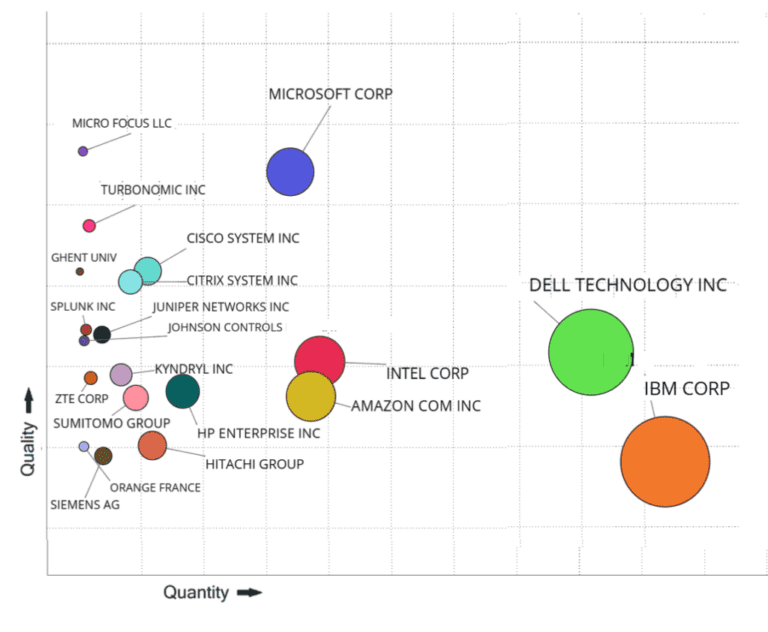

Running PatSeer Pro X – Quality vs Quantity analysis, gives us a better glimpse of the situation. In the chart below the patent holders have been selected based on their portfolio value index (as opposed to portfolio size).

IBM’s overall portfolio quality has struggled against the other dominant players in the space. Turbonomic clearly stands out as a challenger with a relatively smaller portfolio but with a higher quality making it an ideal opportunity for IBM.

Double checking by analyzing the Innovation Caliber of Turbonomic (Time taken – 10 minutes)

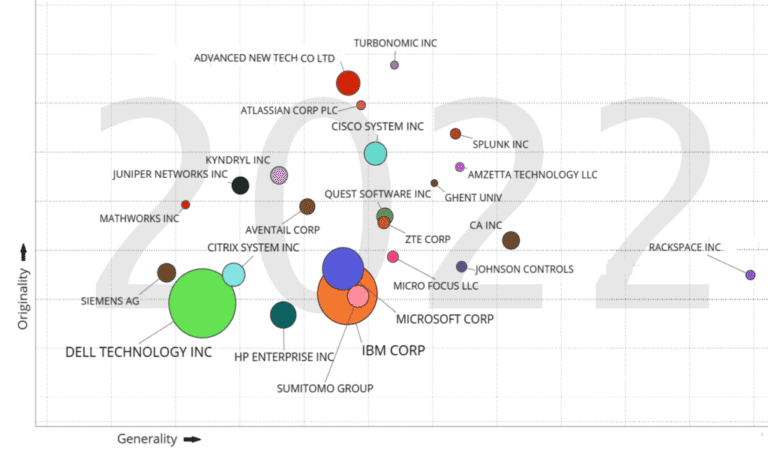

PatSeer Pro X’s chart of originality vs. generality is a very good indicator of the portfolio’s innovativeness. Originality is a measure of how much original thinking has gone into the invention, while generality measures the capability of the invention to be applied across different technology domains. Highly innovative portfolios with multiple avenues for economic realisation would have higher Originality and Generality and they lie towards the top-right quadrant.

We can see that a few companies such as Turbonomic Inc, Advanced New Technology Co Ltd, Atlassian Corp PLC rank highly here. They fall under the ‘highly innovative, high economic potential’ quadrant

Grabbing a cup of coffee to reflect upon the analysis (Time taken – 5 minutes)

The quality metrics of PatSeer Pro X clearly show that Turbonomic’s patents put it as a strong challenger in the Virtualisation space. By ranking high on patent portfolio quality and also on the innovative potential, Turbonomic’s technologies were clearly attractive to IBM which had a dominant portfolio and (therefore) a lot of R&D investments in the same space.