Share

Share

Why Patent Valuation Matters for Your Business Strategy

In the current knowledge-based economy, a company’s competitive advantage and market positioning greatly influence its intellectual property (IP) assets, especially its patent portfolio. In such cases, it becomes necessary to determine the actual worth of patents. This is where patent valuation is relevant. Patent valuation refers to assigning a monetary value to patents or patent portfolios, letting businesses to assess their economic worth, strengthen their market position, and facilitate patent transactions.

It is an important factor for companies because it affects strategic choices about licensing, fundraising, legal matters, and mergers and acquisitions (M&A). A company can make more judicious product-market decisions by knowing the value of its patent portfolio.

Benefits of Knowing Your Patent's Worth

Conducting a patent valuation is offers numerous strategic advantages to the business success.

- Licensing Negotiations

With proper patent valuation, companies can negotiate their licensing agreements from a position of strength and make sure the terms and conditions are appropriately aligned with the patent’s true worth.

- Mergers and Acquisitions

Patent valuation helps identify synergies, cost savings, and potential risks (infringement, validity challenges) within patent portfolios. It is crucial for due diligence in mergers and acquisitions to accurately assess the intellectual property value of the target company.

- Litigation

Patent valuation quantifies the potential financial impact of patent infringement, strengthening negotiation positions and supporting damage claims.

- Fundraising

Accurate patent valuation demonstrates a technology’s commercial potential, attracting investors by highlighting the potential return on investment. A strong valuation boosts investor confidence in a company’s intellectual property and increases the likelihood of securing funding.

Beyond commonly recognized benefits, there are several other advantages of patent valuation like portfolio management, risk assessment, fostering culture of innovation, financial planning, etc.

Key Factors Influencing Patent Valuation

A) Technological merits

Patents with high novelty often provide a significant competitive advantage, increasing their value. Broad claims encompassing a wider range of applications typically enhance a patent’s value due to increased novelty. Early-stage patents offer high reward but higher risk, while mature patents are less risky but face increased competition.

B) Applicable market and potential

A larger market typically implies a greater potential customer base, leading to higher potential revenue generation. A market with strong growth potential indicates a higher likelihood of increased revenue and profit over time, enhancing patent value. A patent with a large, growing market and strong potential for high market share is generally considered more valuable than one with a limited market and slow growth prospects.

C) Competitive forces

A patent’s value is influenced by market factors. Market leader patents often hold higher value due to their potential to maintain dominance. Competitive markets and substitute technologies can significantly reduce patent value. Patents in less competitive markets with fewer substitutes are more valuable.

D) Legal Strength

Clear and well drafted claims enhance the patent’s enforceability and reduce the risk of invalidity challenges. Claims that define a truly innovative and non-obvious invention always have a higher value.

E) Financial Performance

For patents that are already generating revenue, financial data plays a key role in the valuation process. Historical revenue, profit margins, and future income projections based on the patent’s use in products or services can significantly influence the valuation outcome.

PatSeer’s Valuation Matrix

To assist in the patent valuation process, tools like PatSeer’s Valuation Matrix provide a detailed assessment of a patent family’s quality through multiple indicators.

Patent Family Level Quality Indicators

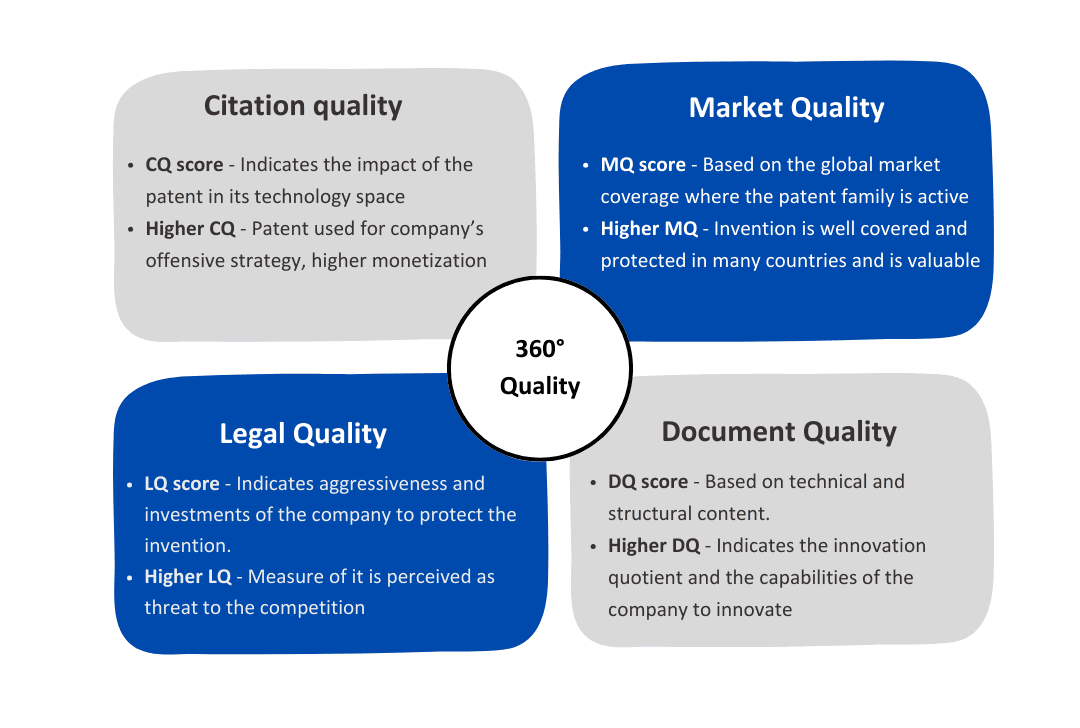

Each patent family in PatSeer is evaluated against more than 30 parameters, resulting in four distinct quality indicators: Citation Quality, Market Quality, Legal Quality, and Document Quality. These indicators are then combined to create a comprehensive 360° Quality Score that offers a holistic view of the patent family’s value.

- Citation Quality (CQ): Reflects the patent’s impact within its technological domain, with higher scores indicating greater potential for monetization and strategic utilization.

- Market Quality (MQ): Assesses the global market coverage and protection of the patent, with higher scores indicating a broader and more valuable market presence.

- Legal Quality (LQ): Measures the level of legal investment and the perceived threat posed by the patent to competitors, with higher scores reflecting stronger legal robustness and competitive positioning.

- Document (Intrinsic) Quality (DQ): Evaluates the intrinsic technical and structural quality of the patent, indicating the depth of innovation and the company’s ability to innovate.

360° Quality Score

The 360° Quality Score is a weighted average of the four contributing scores, with Citation Quality receiving the highest weight, followed by Market Quality, Legal Quality, and Document Quality. This composite score provides a balanced and thorough evaluation of the patent family’s overall value.

Figure: This diagram illustrates the four key quality indicators that contribute to PatSeer’s comprehensive 360° Quality Score for evaluating patent value

Choosing the Right Valuation Method

Selecting the appropriate patent valuation method is crucial for accurately assessing a patent’s worth. The best method depends on various factors like patent development stage, purpose of valuation, market conditions, patent strength and scope.

Given the increasing volume and complexity of patent portfolios, pre-built patent scores, such as those offered by PatSeer, a patent search and analytics software, provide a valuable initial assessment. These scores can streamline the evaluation process, allowing for efficient prioritization of patents for deeper analysis. Essentially, these tools serve as a time-saving filter, helping to focus resources on the most promising patent assets.

Additionally, conducting an FTO Search (Freedom to Operate Search) using a comprehensive intellectual property database can further ensure that a company’s patents do not infringe on existing patents, adding another layer of confidence in the valuation process.

Patent valuation transforms intangible intellectual property into a tangible asset, driving business growth and profitability. It provides a clear foundation for strategic decisions like sales, licensing, mergers, and acquisitions. By identifying high-value patents, businesses can maximize their IP’s potential.

PatSeer, an advanced AI-driven patent intelligence platform, empowers businesses to unlock the full potential of their IP. Whether you are navigating licensing negotiations, preparing for mergers and acquisitions, or simply looking to enhance your IP strategy, PatSeer provides the insights and AI enabled tools necessary to ensure that your patents are accurately valued and effectively managed.